Price Fluctuation Patterns and Procurement Recommendations for Tool Steel in China

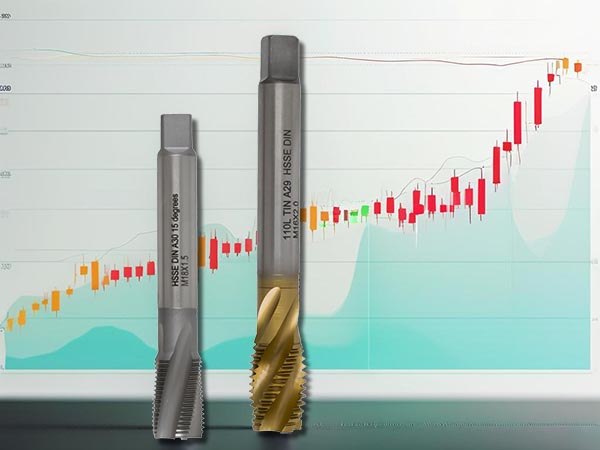

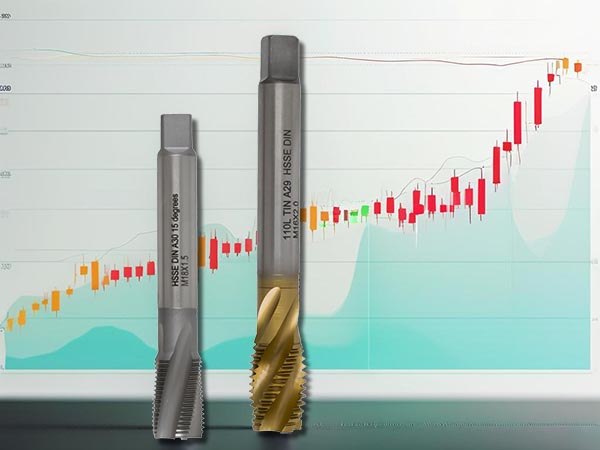

The price dynamics of China's tool steel market resemble an undercurrent—subtle yet constantly tugging at the cost structures of export-oriented manufacturing companies. From environmental production curbs at tungsten mines in Jiangxi to the surge in Christmas orders from North America, from seasonal transport bottlenecks to new cross-border e-commerce regulations, a multitude of factors intertwine to create a unique volatility landscape. For foreign trade enterprises specializing in HSS taps and carbide drills, understanding these patterns is not only key to protecting profit margins but also critical to ensuring order fulfillment. This article offers a deep analysis of market fluctuation characteristics over the past three years, along with a practical guide covering timing strategies, regional sourcing tactics, and technical substitution plans—helping businesses build a "cost moat" amid market swings.

The "Three-Part Symphony" Behind Price Volatility

1. Raw Material Supply: The "Barometer"

- Case Study: In 2023, tungsten mines in Jiangxi halted production for 28 days due to stricter environmental regulations, causing tungsten prices to spike by 23% and raising carbide tool costs by 8%.

- Procurement Alert: Closely monitor environmental inspection announcements in major mining areas like Chenzhou (Hunan) and Ganzhou (Jiangxi) each June and December.

- Substitution Strategy: When molybdenum prices exceed RMB 350,000/ton, consider switching to nitrogen-containing alloy steels to reduce material costs by 12–15%.

2. Demand Fluctuation Timeline

- Domestic Peak Season: Demand for die steels surges after the March automotive parts exhibitions (2024 show orders up 40% YoY).

- International Window: North American tool distributors restock intensively 60 days before Thanksgiving (September–October); securing raw materials 45 days in advance is recommended.

- Emerging Markets: Infrastructure project tenders in Vietnam tend to cluster after the rainy season (November); carbide drill stockpiling should be prepared beforehand.

3. Policy-Driven "Butterfly Effects"

- Export Rebate Policy: In 2023, the export tax rebate rate increased from 9% to 13%, driving a 67% YoY surge in September procurement volumes.

- Transport Restrictions: During winter traffic controls in the Beijing-Tianjin-Hebei region (December–January), prioritize Qingdao Port over Tianjin Port for shipping.

- Electricity Price Fluctuations: Summer peak electricity demand (July–August) in Guangdong province drove electric furnace steel production costs up by RMB 200–300 per ton.

A Full-Spectrum View of Material Price Cycles (with Actionable Strategies)

1. Tool Steel Procurement Calendar

| Month | Price Trend | Practical Tactics |

|---|

| January | Steel mills clear inventory, offering 5–8% discounts | Prioritize purchases of general-purpose grades like M2 HSS |

| April | Prices rise 3% after the Canton Fair | Sign supplier contracts capping price hikes at 5% |

| July | Rainy season transport delays raise costs | Switch to local mills plus rail transport combo |

| October | Export order leftovers cause small-batch shortages | Build an emergency supplier list (minimum three sources) |

2. Carbide Procurement Pitfalls to Avoid

- Price Sensitivity: Every RMB 10,000/ton change in cobalt prices causes carbide costs to fluctuate by ~RMB 600/m³.

- Quality Traps: Beware of molybdenum iron substitution during December small mill restarts (quick detection method: use a magnet to test material attraction).

- Storage Tips: Maintain warehouse humidity ≤60% during the wet season to prevent tungsten carbide rusting.

3. Hidden Costs of Coating Materials

- PVD Coatings: High summer temperatures lower the pass rate of PVD coatings by 10–15%; staggered procurement is advised.

- TiAlN Coatings: Japanese suppliers typically adjust prices in March—lock in deals with Korean or Chinese suppliers one month early.

- Shipping Caution: Avoid transporting nano-coating materials with acidic or alkaline substances (Case Study: RMB 300,000 worth of goods scrapped in 2022 due to contamination).

Three Core Tactics for Procurement Cost Control

1. Timing Tactics

- Stockpile inventory before long holidays like Spring Festival/National Day (biggest price negotiation window: 7 days before logistics shutdown).

- When international metal futures slump during night trading (9–11 PM), inquire prices first thing next morning.

- Price negotiation success rates are highest three days before mills finalize monthly settlements (around the 25th).

2. Spatial Allocation

- Regional Price Differentials: East China offers cheaper sheet steel (but high freight costs), while Southwest China offers advantages in bar steel (see 2023 regional price differential chart).

- Port Choices: For shipments over 200 tons, using Qinzhou Port saves ~RMB 80 per ton compared to Shenzhen Port.

- Transport Combos: Railway + highway multimodal transport reduces logistics costs by 15–20%.

3. Technical Cost Reduction Secrets

- Specification Optimization: Switching from φ12mm to φ11.8mm bar stock improves material utilization by 7%.

- Scrap Recycling: Partnering with local smelters to recycle tungsten scrap cuts material costs by 3–5%.

- Equipment Upgrades: Replacing conventional lathes with CNC grinders can reduce material wastage by ~8%.

New Developments to Watch

- Special steel demand surges driven by the expansion of the new energy sector (e.g., photovoltaic tool steels).

- Cross-border e-commerce orders are shifting toward small-batch, high-frequency purchasing trends.

- Shipping times for imported materials have extended from 45 days to 60–75 days.

Essential Industry Updates

1. Cross-Border E-Commerce New Regulations

- Alibaba International requires material certification for cutting tool listings (recommendation: prepare EN ISO 4957 certification in advance).

- Overseas warehouse inventory formula: (Daily average sales × 45 days) + 30% safety stock.

2. Green Manufacturing Requirements

- EU carbon tariff trials now include cutting tools—keep detailed electricity usage records for the past three years.

- Water-based eco-friendly coolant procurement comparison table available (traditional vs. new generation coolants).

3. Smart Procurement Tools

- Recommended applet: "SteelSilver Cloud Procurement" for real-time price comparison (includes direct supply from five major mills).

- Recommended customs data subscription services (focus: tungsten product import volume monitoring).

Conclusion

Tool steel procurement is ultimately a precision game against market volatility. By seizing critical timing windows (e.g., January mill clearance, September export rebate surge), leveraging regional price patterns between East and Southwest China, and applying material optimization technologies, businesses can achieve procurement cost reductions of 8–15%.

Facing fragmented cross-border e-commerce orders and the challenges posed by new carbon tariff policies, companies are advised to establish dynamic monitoring systems linking customs data, futures trends, and production planning. Notably, the surge in demand for photovoltaic tool steels in 2024 coincides with Southeast Asia's infrastructure boom—early adoption of cost-effective alternative materials will be a key competitive advantage.

Only by transforming market rhythms into procurement strategies can companies truly seize the initiative amid fluctuations.

We like to do design according to all the customers' requirements, or offer them our new designs. With strong OEM/ODM capabilities, we can fill your sourcing demands.

We like to do design according to all the customers' requirements, or offer them our new designs. With strong OEM/ODM capabilities, we can fill your sourcing demands.